Many interesting market forces in Whatcom County are currently at play: a global pandemic and corresponding job losses, an influx of residents due to wildfires and retirement planning, and a shift from the office to working from home. How do we see this playing out in Whatcom County's real estate market in 2021?

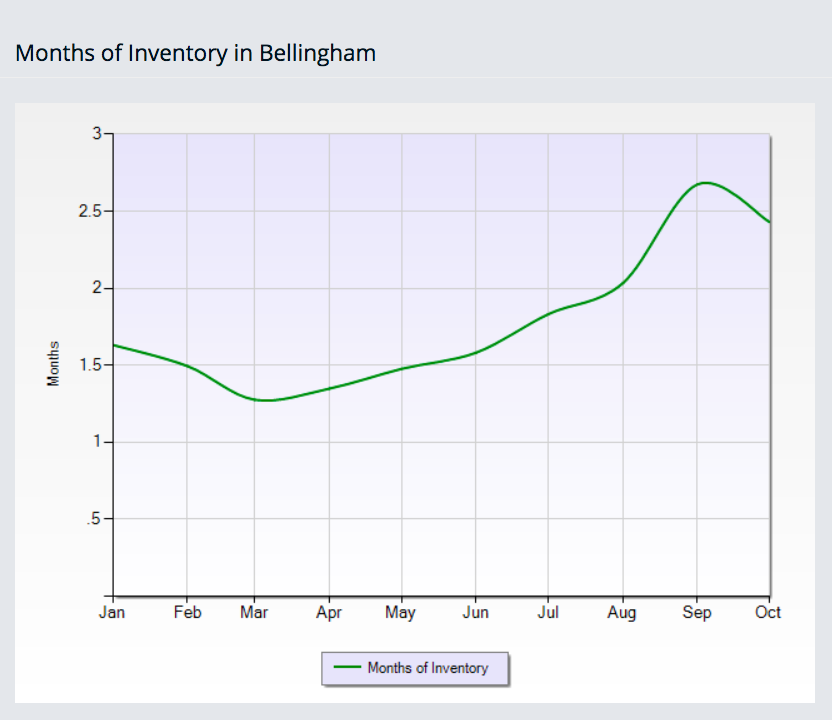

Northwest MLS data confirms what Compass brokers are feeling: record low inventory in homes for sale. Inventory is less than 30 percent of what it was one year ago. Fewer choices for buyers are driving up prices; multiple offers have become commonplace. Median home prices are up 11.3 percent from January 2020.

Will this pace of appreciation continue? I see no reason why not. Interest rates are still at historic lows with a commitment from the feds to remain that way throughout the year. And employment numbers in Western Washington continue to improve. Unemployment rates currently sit at 8 percent, down from April's 16.6 percent. In addition, many people moving to Whatcom County have new workplace flexibility and aren't relying on the local economy for employment. In fact, Bellingham has recently become dubbed a "Zoom town," in part because of its proximity to the Seattle tech hub. Many people are moving from more expensive markets with impressive equity in-hand. For these reasons, I’m anticipating similar market appreciation in 2021 and for it to remain a seller’s market.